In Singapore, share certificates are legal documents attesting to the ownership of a specific number of shares in a company issued to a shareholder.

For private limited companies, it is delivered in a paper format whereas public listed companies issue an electronic version. There are many situations in which share certificates are delivered. Among them, it is an important step during the incorporation of a new company or when a shareholder is investing in an existing company. In this article, we aim to provide clarification on various aspects related to share certificates, which include:

A share certificate is a document issued by the company to its shareholders, that evidences their ownership of shares in the company. In Singapore, it is prepared and issued by the company secretary and often kept at the company secretary offices to prevent their loss.

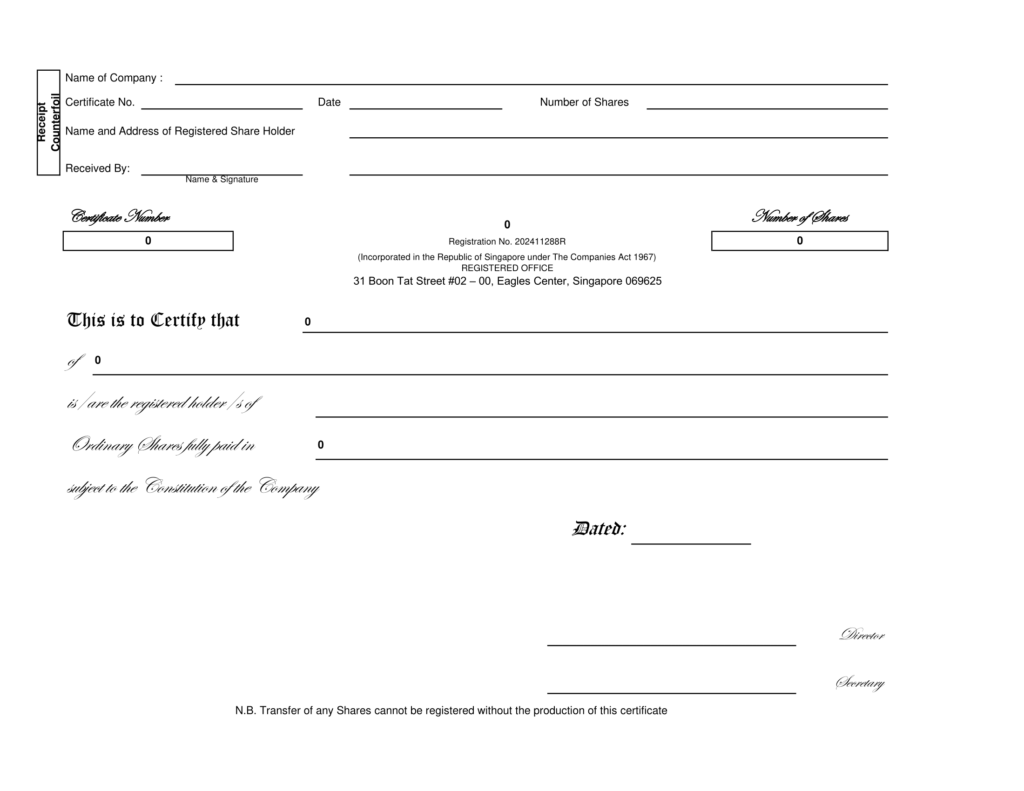

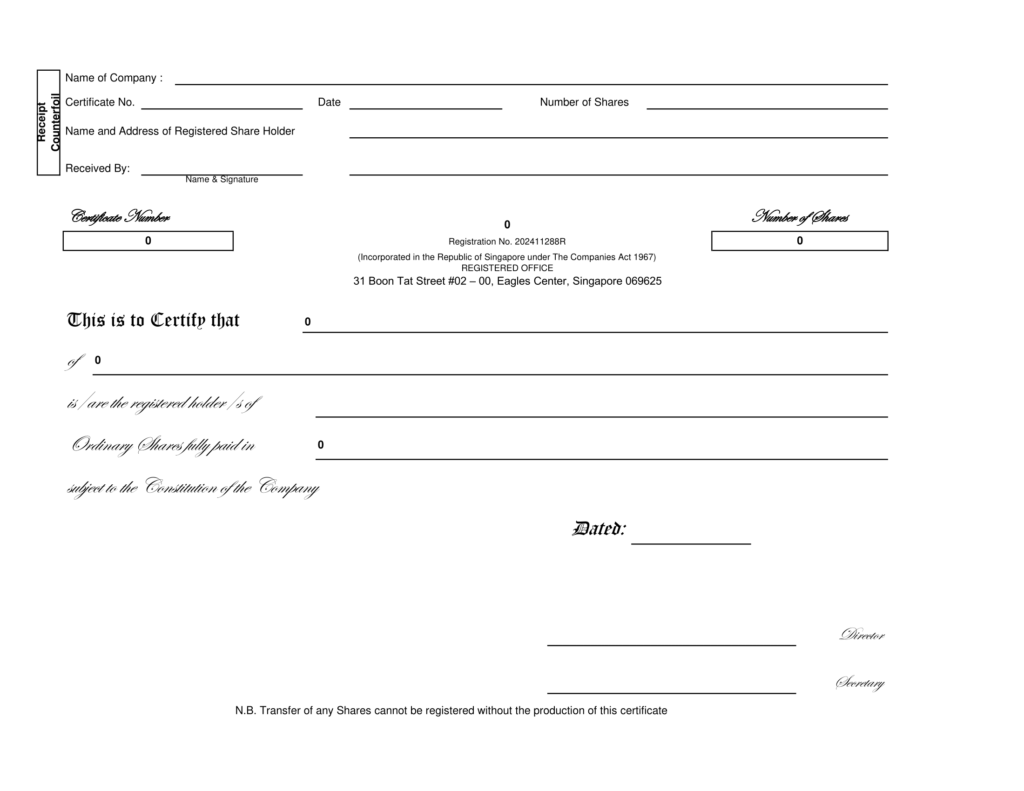

It usually contains the company’s name and legal address, the authority under which it is constituted, its registration number, the shareholder’s name and address, the number and class of the shares that are being issued, the date of issuance of the certificate, and whether the shares are fully or partly paid up (and the unpaid amount if any). Therefore, a shareholder does not necessarily need to directly pay the full amount of shares to have a certificate.

Share certificates are not required since 31 March 2017 to use the common seal to be executed in Singapore (41A Companies Act), if the procedure in section 41B of the Companies Act (CA) is followed. Instead Under section 41B, a company may execute documents only by signature:

Share certificates are generally issued on 3 occasions: the allotment of shares, the transfer of shares, and the loss of the share certificate, with different procedures for each.

To increase its share capital, a company issue new shares to existing or new shareholders. The board of directors must first get the shareholders’ approval in a general meeting before issuing the shares.

After the approval, the company secretary must prepare the relevant documents, lodge the record with the Accounting and Corporate Regulatory Authority (“ACRA”) within 14 days, and then prepare the new share certificate(s) with details about the shares allotted (number of shares, amount paid or unpaid, class of the shares, personal information of the company’s shareholder(s)).

A shareholder may transfer or sell their shares to an individual, a corporation, or back into the company, either wholly or partly. In the first case, the shareholder will cease to be a shareholder, and in the second, he will remain a shareholder but with fewer shares.

The company secretary will have to prepare the board resolution, the instrument of transfer and the stamp duty acknowledgment from the Inland Revenue Authority of Singapore (“IRAS”). The secretary will also lodge the record with the ACRA, before canceling the original share certificate(s) and preparing the new one(s). If only a portion of shares is being transferred, the original certificate will be replaced by two new share certificates, one for the transferor and the other one for the transferee.

In the case of loss of the share certificate, the shareholder must inform the company by submitting a statutory declaration. The company secretary can then provide a duplicate copy of the share certificate, after preparing a board resolution to record the loss and canceling the previous one.

If the value of the shares is greater than S$500, there are additional requirements for the shareholder, such as publishing an advertisement in the newspaper stating the loss of the certificate and that the owner will apply for a new one within 14 days, and providing a bond for an amount equal to the shares’ current market value to indemnify the company against loss if the original certificate is produced.

The time limit depends on whether the certificate is issued after an allotment of shares or after a transfer of shares. In the first case, the share certificate must be delivered to the shareholder within 60 days after the shares are allotted. In the second case, it must be delivered to the shareholder within 30 days from the date the transfer was lodged with ACRA.

Non-compliance with these deadlines constitutes an offense under the Companies Act, resulting in a fine not exceeding 1,000 SGD and a default penalty.

A share certificate is first issued when incorporating a company. Thereafter, it can be issued during a share capital increase with allotment of new shares or during a transfer of shares. If an existing share certificate is lost or destroyed, the company secretary can also provide a duplicate copy. The issuance of such a document is important because it constitutes proof that a shareholder is the owner of the whole or part of the shares in a company.

1. What kind of shares can be issued by companies?

A corporation has the option to issue various kinds, or “classes,” of shares. These can include:

2. Who prepares the share certificates in a company?

The company secretary handles share certificate preparation, maintains the shareholders’ register, and ensures legal compliance.

3. When do I need to issue share certificates?

Besides the initial incorporation of the company, share certificates are issued in the following instances:

4. What details does a share certificate have?

The certificate generally contains information such as the company’s name, registration number, address, the shareholder’s name and address. Additionally, it outlines the class and category of shares owned, along with their corresponding nominal value

5. Do share certificates in Singapore have to be physical documents?

While it’s not legally required, companies commonly choose to issue physical share certificates to serve as tangible proof of ownership.

6. How many share certificates do I need?

In Singapore, every shareholder has the right to obtain a minimum of one share certificate representing their entire holdings. However, it’s advisable to provide multiple copies for convenience or in cases involving multiple shareholders.

7. Do I have to pay for all shares upfront?

Shareholders can choose to pay for shares either fully or partially. If fully paid, the shares belong entirely to the shareholder. However, even if only a portion of the total shares is paid for, the shareholder still receives a share certificate indicating the total shares purchased. The certificate must specify the payment status to minimize misunderstandings and legal consequences.